Part III-A: The Extraction Code Across Healthcare and Housing

How the Same Infrastructure Repeats Across Healthcare, Housing, and Finance

Series: The Extraction Code

Part I | Part II | Part III-A | Part III–B | Part III–C | Part IV-A | Part IV–B | Part V

Paid members unlock the Weekly Intelligence Report (Case File): one real-world case mapped to the funnel, decoded line-by-line, and fully sourced.

A framework you can apply in real time: who must enter, where friction is added, who can say no, and where gain concentrates.

Subscribe Now: Introductory offer: 25% off monthly and annual paid subscriptions through Jan 23, 2026.

How the Same Infrastructure Repeats

The Pattern Is the Point

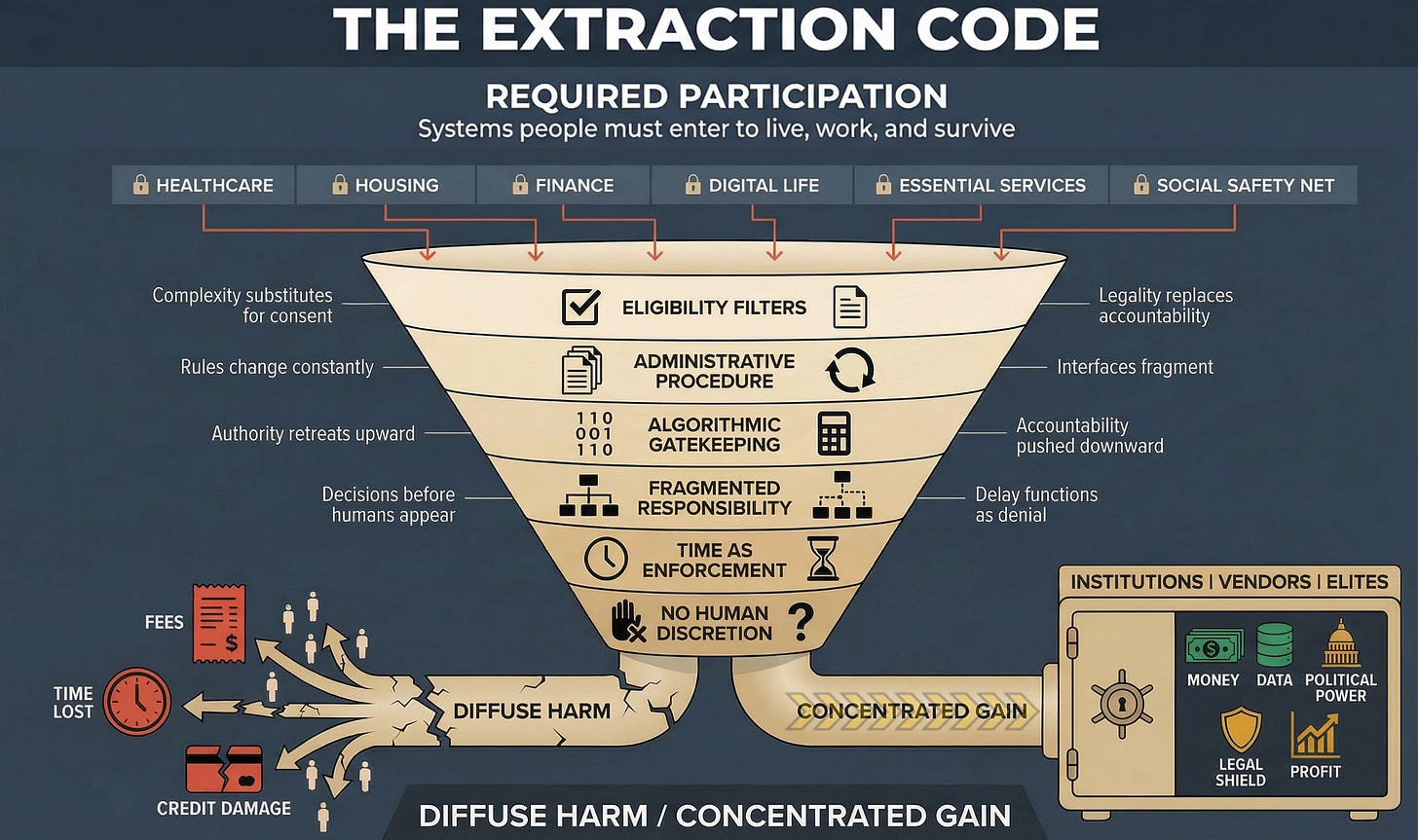

In Parts I and II, we established that the Extraction Code is not accidental complexity or bureaucratic drift; it is deliberate infrastructure built through specific policy choices, regulatory capture, corporate consolidation, and bipartisan consensus. We mapped the six-layer funnel that transforms required participation into concentrated gain while making individuals feel personally responsible for systemic failure.

Now we examine how this same architecture repeats across sectors with remarkable consistency.

The funnel doesn’t care whether you’re seeking healthcare, housing, credit, platform access, or government benefits. The mechanisms are identical: required participation, procedural compression, algorithmic gatekeeping, fragmented responsibility, time as enforcement, and the elimination of human discretion.

What changes are the language, the vendorscape, and the specific procedural barriers. What remains constant is the outcome: diffuse harm, concentrated gain, and legal immunity.

This is not a coincidence. This is a coordinated design. The same consulting firms, the same technology vendors, the same policy frameworks, the same legal strategies, exported across sectors, refined through iteration, optimized for extraction.

Healthcare: The Prior Authorization Labyrinth

Required Participation

You cannot opt out of the need for medical care. The Affordable Care Act made insurance mandatory (or penalized non-participation). Even if you’re uninsured, you still must navigate hospital billing, prescription access, and emergency care systems designed around insurance-based gatekeeping.

The Funnel in Action

Layer 1 - Eligibility Filters: Network restrictions. In-network vs. out-of-network designations that change without notice. Formulary tiers that determine which medications are “covered” (translation: which ones won’t bankrupt you). Referral requirements require you to go through primary care gatekeepers before accessing specialists.

Example: You need to see a cardiologist. First, you must schedule an appointment with your primary care physician (a 3-week wait). Then get a referral (2-week processing). Then find an in-network cardiologist who accepts new patients (a 6-week wait for the first available appointment), total time before you can address the chest pain: 11 weeks. If you go directly to a cardiologist without a referral, you’ll pay out-of-network rates, meaning you’ll pay 70% instead of your copay.

Layer 2 - Administrative Procedure: Prior authorization. The insurer demands proof that the treatment your doctor ordered is “medically necessary” before approving coverage. This requires your physician’s office to submit detailed clinical documentation, often to a third-party vendor the physician has never heard of, using procedure codes that may not match the diagnosis, through a portal that crashes regularly.

Example: Your oncologist orders a scan to monitor treatment progress. The prior authorization requires: (1) submission of your complete medical history, (2) documentation of previous treatments and outcomes, (3) clinical justification for this specific scan vs. alternatives, and (4) peer-to-peer review where your oncologist must defend the decision to an insurance company physician who may not specialize in oncology. Timeline: 10-14 days. Your scan was supposed to happen in 7 days. If you proceed without authorization, you pay $8,000 out of pocket.

Layer 3 - Algorithmic Gatekeeping: AI-driven denial systems. Insurers now use artificial intelligence to auto-deny claims based on diagnosis codes, procedure patterns, and “medical necessity” algorithms trained on cost minimization rather than patient outcomes.

Example: EviCore (a subsidiary of Cigna) operates prior authorization systems for radiology and cardiology services across multiple insurers. Their AI auto-denies approximately 30% of requests on first submission. Physicians report that the same request, submitted identically three times, may be approved on the third try, not because anything changed clinically, but because the system is designed to reward persistence and punish physicians who don’t have time to appeal.

The criteria are proprietary. The decision logic is protected as a trade secret. Your physician cannot see why the scan was denied, cannot challenge the algorithm’s clinical judgment, and cannot escalate to a human reviewer without completing the appeal process, which takes another 14 days.

Layer 4 - Fragmented Responsibility: Who denied your treatment? Not the insurer, they contract with a Pharmacy Benefit Manager (PBM) for drug coverage. The PBM contracts with a prior authorization vendor for utilization review. That vendor uses an AI system built by a technology company. When your medication is denied, the insurer says it’s because it’s not on the formulary (a PBM decision). The PBM says it’s a medical necessity (vendor decision). The vendor says it’s an algorithm (a technology decision). The technology company says it’s the training data (which reflects the insurer’s cost priorities).

Accountability has dissolved across the contract chain. No single entity can be held responsible. And by the time you’ve navigated the blame loop, you’ve either paid out of pocket, switched to a less effective medication, or given up.

Layer 5 - Time as Enforcement: Prior authorization timelines are calibrated to maximize attrition. Urgent requests get 72-hour reviews. Standard requests get 14 days. Appeals can take 30-60 days. But your prescription runs out in 7 days. Your surgery is scheduled in 10 days. Your pain is unbearable now.

The system doesn’t have to explicitly deny you. It just has to outlast your patience.

Layer 6 - No Human Discretion: When you call to appeal, you reach a call center worker in the Philippines reading from a script. They cannot override the denial. They cannot escalate to a supervisor with authority. They cannot make exceptions for extraordinary circumstances. They can only tell you to submit another appeal, which will be reviewed by another algorithm applying the same criteria that denied you the first time.

The Output

Diffuse Harm: Delayed care. Worsening conditions. Medical debt. Time lost to appeals. Treatment abandonment. Patient deaths.

Concentrated Gain: Insurance company profits hit record highs. PBMs extract billions in spread pricing (the difference between what they pay pharmacies and what they charge insurers). Prior authorization vendors bill per transaction, meaning every denial, every appeal, every resubmission generates revenue. AI vendors license their systems across multiple insurers, scaling extraction across the entire healthcare system.

Paid subscribers receive:

📊 Daily: 3 extraction signals with immediate counter-moves

🔍 Weekly: Investigative Case Files (decoder tables, accountability maps)

📈 Monthly: Sector Pattern Reports (what is brewing before it breaks)

Subscribe Now: Introductory offer: 25% off monthly and annual paid subscriptions through Jan 23, 2026.

Housing: The Application Gauntlet

Required Participation

You cannot opt out of needing shelter. Whether you’re renting, buying, or accessing subsidized housing, you must navigate systems designed to filter people out while extracting maximum fees, data, and leverage.

The Funnel in Action

Layer 1 - Eligibility Filters: Minimum credit score requirements. Income requirements (typically 3x monthly rent). Rental history verification. Background checks. Employment verification. Reference letters. Pet policies. No eviction history. No criminal record (even for charges that were dismissed or expunged).

Example: You apply for an apartment listed at $1,800/month. The application requires: (1) $75 application fee (non-refundable, per applicant), (2) a credit score above 650, (3) documented income of $5,400/month, (4) three years of rental history with landlord contact information, (5) employer verification, and (6) two personal references. If you’re self-employed, you need tax returns. If you have a co-signer, they need all of the above. If you have a pet, add a $500 deposit plus $50/month pet rent.

Before you can even view the apartment, you’ve paid $150 (you and your partner) and compiled documents that take 6-10 hours to gather. You’ll submit this same packet to 15 apartments because inventory is scarce and competition is high. Total cost before you secure housing: $1,125 in application fees alone.

Layer 2 - Administrative Procedure: Each landlord uses a different application portal. One requires RentSpree. Another uses Zillow. Another has a proprietary system. None of them integrates. You must re-enter the same information, re-upload the same documents, and re-pay the same fees for every application.

Example: You apply through a property management company that uses AppFolio. They run a background check through TransUnion. But your credit report shows an error—a medical debt that was paid three years ago is still listed as delinquent. You dispute it. TransUnion says allow 30 days for investigation. The apartment will be rented by then. You’re filtered out, not because you’re unqualified, but because the system has no mechanism for context, nuance, or error correction.

Layer 3 - Algorithmic Gatekeeping: Tenant screening algorithms now analyze not just credit scores but “risk profiles” based on income volatility, employment patterns, rental payment history, and predictive models that claim to forecast eviction risk.

Example: SafeRent Solutions (a CoreLogic company) provides tenant screening for property managers nationwide. Their algorithm assigns a “recommendation score.” If you score below the threshold, you’re auto-rejected, even if you’ve never missed a rent payment, even if your income is stable, even if every landlord reference is positive. The criteria are proprietary. The score methodology is protected as a trade secret. You cannot see why you were rejected, cannot challenge the data inputs, and cannot appeal to a human reviewer.

If your score was lowered because you lost a job during COVID, had a medical emergency, or experienced any income disruption, even temporary or years ago, the algorithm treats it as a permanent risk.

Layer 4 - Fragmented Responsibility: Who denied your housing application? Not the landlord—they outsource to a property management company. The property management company uses a screening vendor. The screening vendor uses algorithmic scores from a data analytics firm. The data analytics firm pulls information from credit bureaus, eviction databases, and public records aggregators.

When you’re rejected, the landlord says they didn’t make the decision—the screening report did. The screening vendor says they just provide the data—the property manager interprets it. The property manager says they follow the algorithm’s recommendation; they don’t override it. The algorithm’s designer says they analyze patterns, they don’t make housing decisions.

No one is responsible. And you’re homeless.

Layer 5 - Time as Enforcement: Application processing takes 3-7 days. But the apartment market moves in hours. By the time you’re approved, the unit is gone. By the time you dispute an error, the window has closed. By the time you save enough for another round of application fees, rent has increased.

If you’re applying for subsidized housing (Section 8, public housing, or housing vouchers), the timeline can extend for months or years. Waiting lists are closed. Recertification is annual. Any change in income, household composition, or employment requires the resubmission of all documentation. Miss a deadline, lose your place in line.

Layer 6 - No Human Discretion: When you call to ask why you were rejected, you reach a leasing agent who doesn’t make decisions. They forward you to the property management company, which tells you to contact the screening vendor. The screening vendor cannot discuss proprietary scoring methodologies. They can only confirm that the report was accurate based on the data they received. Whether that data is correct, complete, or relevant, it’s not their problem.

There is no supervisor to appeal to. No case worker with authority to grant exceptions. No human in the loop who can say, “This person lost their job during a pandemic, not because they’re irresponsible—let’s give them a chance.”

The Output

Diffuse Harm: Housing instability. Homelessness. Families separated. Children displaced from schools. Workers are unable to relocate for jobs. Application fee debt. Credit damage from repeated hard inquiries. Time lost to the application gauntlet.

Concentrated Gain: Property management companies extract fees at every stage (application, administration, processing, pet, parking, amenity access). Screening vendors’ bills per report. Data analytics firms license algorithms across thousands of landlords. Private equity landlords buy housing stock, raise rents, impose fees, and optimize for maximum extraction while minimizing maintenance.

Finance: The Credit Trap

Required Participation

You cannot opt out of needing credit. Even if you never borrow money, you need a credit score to rent housing, get insurance, access utilities, and increasingly—get hired for jobs. Your credit score is a mandatory participation metric that determines access to survival infrastructure.

The Funnel in Action

Layer 1 - Eligibility Filters: Credit scores determine everything. But building credit requires having credit. First-time borrowers can’t get loans because they have no credit history. People who have paid cash their whole lives are penalized as “credit invisible.” Immigrants, young adults, and anyone who avoided debt are treated as higher risk than people who borrowed and defaulted—because at least the defaulters have a score.

Example: You’re 25, graduated without student loans (worked full-time through college), never had a credit card (used a debit card), and paid rent in cash (roommate situation). You apply for an apartment. Rejected—no credit history. You apply for a car loan to build credit. Rejected—no credit history. You apply for a credit card to build credit. Approved—at 29.99% APR because you’re “high risk” due to lack of credit history.

The system punishes financial responsibility and rewards participation in debt infrastructure.

Layer 2 - Administrative Procedure: Credit reports are riddled with errors—yet disputing them requires navigating byzantine processes across three credit bureaus (Equifax, Experian, TransUnion) that don’t coordinate, don’t share information, and don’t fix errors unless you can prove they’re wrong (even when the burden of proof should be on whoever reported the debt).

Example: A medical debt appears on your credit report. You never received the bill—it went to an old address. You dispute it. Equifax says allow 30 days. After 30 days, they respond: “Verified as accurate.” You ask for verification documentation. They sent a letter stating that the creditor confirmed it. You ask the creditor for proof. They say they sold the debt to a collections agency. You contact the collections agency. They say they bought a portfolio of debts and don’t have the original documentation. You’re stuck in a loop. The debt remains. Your credit score drops 80 points. You’re denied housing, insurance, and employment—because of a debt you may not owe, from a creditor who can’t prove you owe it, verified by a system designed to trust creditors over consumers.

Layer 3 - Algorithmic Gatekeeping: Credit scoring algorithms are proprietary. FICO won’t disclose the exact formula. VantageScore won’t explain the weighting. Lenders use internal risk models that combine credit scores with other data—income volatility, geographic risk profiles, shopping behavior tracked through data brokers—to make lending decisions you cannot see, cannot challenge, and cannot understand.

Example: You apply for a mortgage. Denied. You ask why. The lender says your credit score was too low. You check your score—it’s 720, well above the advertised minimum of 680. You ask for details. They say the decision was based on “comprehensive risk assessment.” You request the criteria. They say it’s proprietary. You file a complaint. The lender provides a generic adverse action notice listing six possible reasons, with no indication of which ones applied to you or how much weight each carried.

You cannot fix what you cannot see. You cannot challenge what you cannot understand. You cannot appeal to an algorithm.

Layer 4 - Fragmented Responsibility: Who decided you’re not creditworthy? Not the bank—they use a FICO credit scoring model. FICO uses data from the credit bureaus. The credit bureaus get data from creditors, collections agencies, and public records. The collection agencies bought portfolios from debt buyers. The debt buyers purchased accounts from original creditors who may no longer exist.

When your credit score tanks because of an error, the bank says they didn’t generate the score. FICO says they didn’t generate the data. The credit bureaus say they didn’t originate the debt. The collections agency says they’re just reporting what they purchased. The original creditor is unreachable.

No one is responsible for the error. Everyone profits from the system.

Layer 5 - Time as Enforcement: Negative items remain on your credit report for 7 years (10 years for bankruptcy). Disputing errors takes 30-90 days per bureau. Rebuilding credit takes years of perfect payment history. But you need credit now—to rent housing, to get a job, to access emergency funds.

The timeline is designed to maximize harm. By the time you’ve cleared the error, you’ve lost the apartment, the job, the loan. By the time you’ve rebuilt your score, you’ve spent years paying predatory interest rates, excessive deposits, and penalty fees.

Layer 6 - No Human Discretion: When you call the credit bureau to dispute an error, you reach an automated system. When you finally get a human, they cannot override the report—they can only initiate a dispute, which goes to the creditor who reported it, who has a financial incentive to verify it as accurate rather than admit error. There is no human reviewer who can look at your situation and say, “This is clearly wrong—let’s fix it.” The system runs on automated verification loops that protect creditors, not consumers.

The Output

Diffuse Harm: Predatory lending. Debt spirals. Bankruptcy. Housing denial. Employment rejection (credit checks are now standard for hiring). Insurance rate increases (credit-based insurance scores). Poverty traps (low credit = high costs = more debt = lower credit).

Concentrated Gain: Banks profit from fees and interest. Credit bureaus profit from selling your data to lenders, insurers, employers, and landlords. FICO licenses its scoring model across the entire financial system. Debt collectors profit by buying worthless debt portfolios for pennies and extracting payments through threats to credit scores. Predatory lenders target low-credit borrowers with 400% APR loans, overdraft fees, and payday lending traps.

Paid subscribers receive:

📊 Daily: 3 extraction signals with immediate counter-moves

🔍 Weekly: Investigative Case Files (decoder tables, accountability maps)

📈 Monthly: Sector Pattern Reports (what is brewing before it breaks)

Subscribe Now: Introductory offer: 25% off monthly and annual paid subscriptions through Jan 23, 2026.

Up to now, the funnel has shown up where the stakes are physical: care and shelter.

In Part III-B, we follow the same architecture into finance and platforms, where the gatekeeping is quieter but just as decisive: scores, flags, terms of service, and automated “policy” that becomes your life.

Fascinating & thorough —if depressing— analysis which reveals the end result of “regulatory capture,” how predatory capitalism excels at de-fanging anyone from interfering with unfettered extraction from We the People!

A futuristic fascist takeover. I pray for a massive shot from the sun to break these systems. We are blindly, willingly marching ourselves and our loved ones into an unending nightmare.