Feature Story | Sunday, January 18, 2026

(Part 1 of 2) Part 2 is here

What just happened, and why it matters now

Centers for Medicare & Medicaid Services (CMS) flipped how Medicare Advantage gets audited.

Instead of checking roughly 60 insurance contracts per year, CMS is now auditing all 550 eligible contracts annually, and it set a hard deadline, early 2026, to clear a six-year backlog of unfinished audits from 2018 through 2024.

Most coverage treated this as a technical policy change. What reporters missed was the real-world impact: that backlog contains the evidence of how insurance plans inflated diagnosis codes to collect extra payments, then used that money to build the very systems that now delay your claims, deny your care, and limit your doctor choices.

Three events make the timing urgent:

January 1, 2026: the expanded audit system went fully operational.

January 7, 2026: the Senate Finance Committee gave UnitedHealth, the largest Medicare Advantage insurer, until January 28 to produce documents tied to allegations that nursing home patients died after hospital transfers were refused. Senators called the earlier response “inadequate” and cited whistleblower testimony.

January 14, 2026: the U.S. Department of Justice announced a $556 million settlement with Kaiser Permanente affiliates to resolve allegations tied to Medicare Advantage risk adjustment and diagnosis coding practices.

Why this matters to you: If you or a family member has Medicare Advantage, the plan you are in is being audited now.

Findings can translate into repayment pressure. Repayment pressure often shows up at the household level as benefit changes, tighter networks, and harder authorization pathways.

The Law Provided the Mechanism for Failure

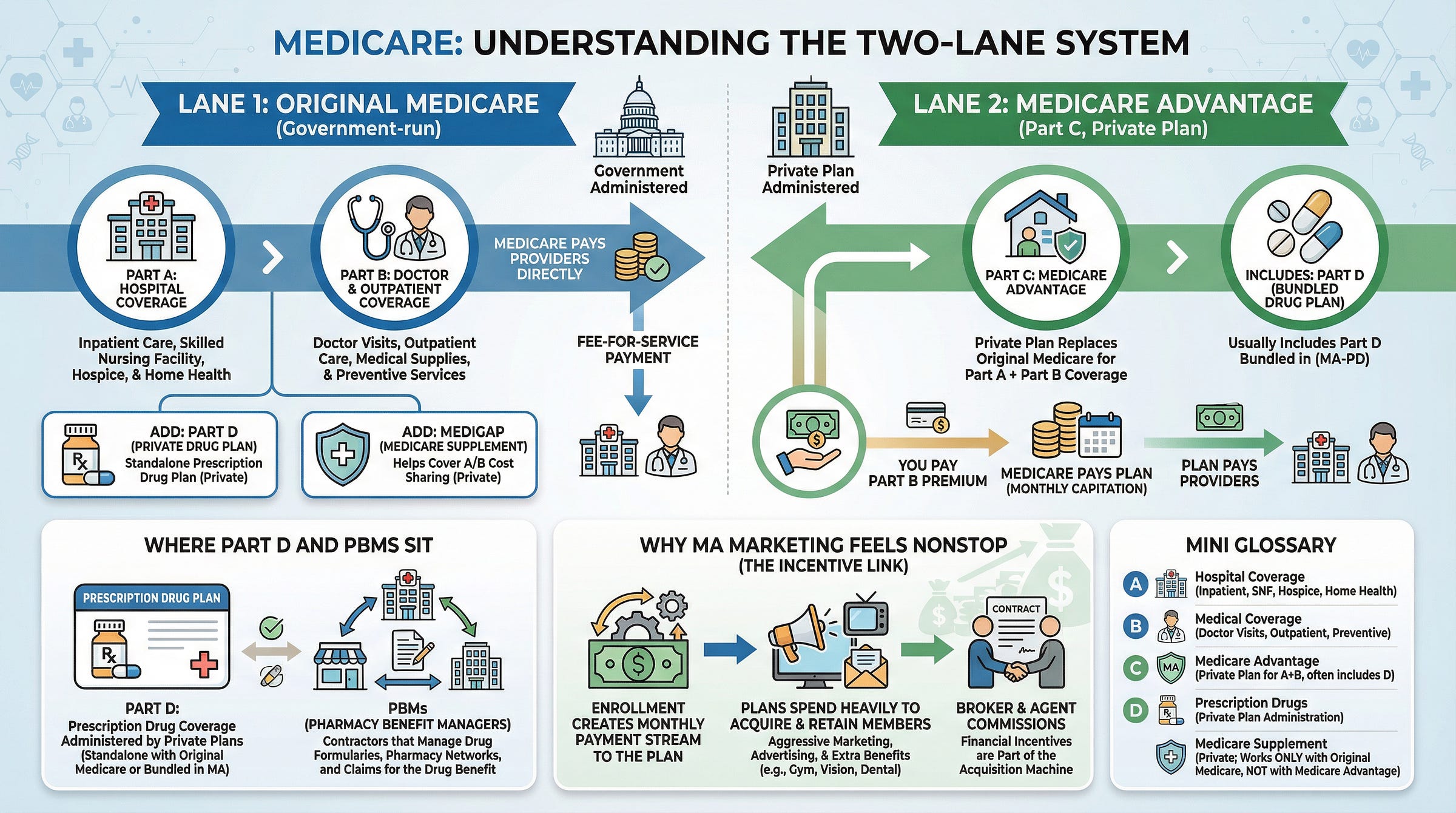

Traditional Medicare pays providers for each service delivered. Medicare Advantage flips the model: the government pays insurers a monthly per-patient amount, and the insurer manages care.

To avoid cherry-picking healthier people, Medicare Advantage uses risk adjustment. Plans get paid more for sicker patients. Each documented diagnosis can raise the plan’s payment.

Here is the part that matters.

Plans learned they could maximize revenue by adding diagnosis codes to charts, including codes that do not change treatment. They hire nurse coders to comb records, find conditions a treating clinician did not document because they were not clinically relevant, submit those codes, and collect higher monthly payments.

Then comes the time lag: the payment comes first. The audit can arrive years later, if it arrives at all.

Denial reality check: what the data says

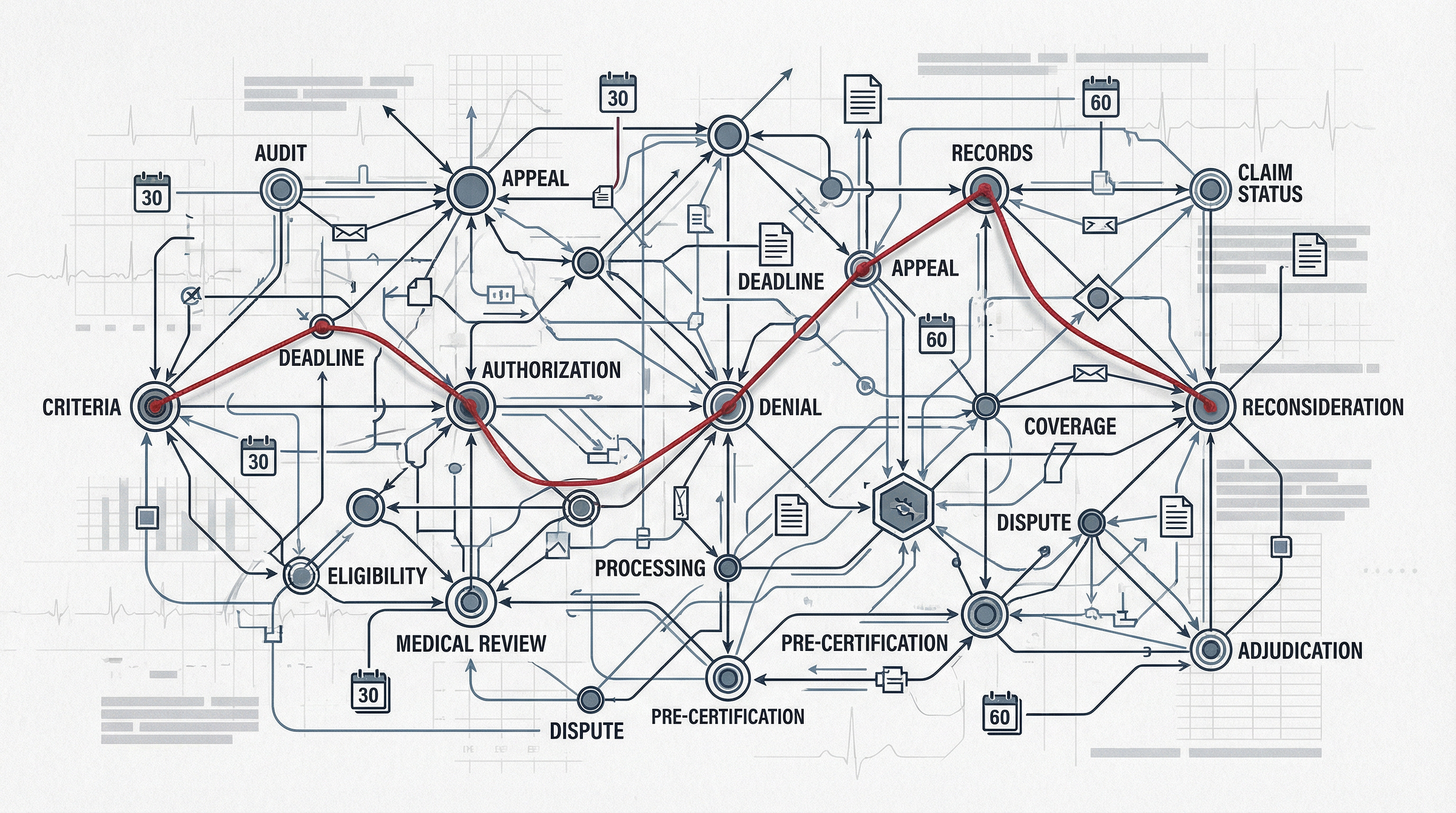

Medicare Advantage is not “fake coverage.” It pays for many services. But it operates through a gatekeeping layer that traditional Medicare often does not require: prior authorization.

KFF reports that in 2023 Medicare Advantage plans made nearly 50 million prior authorization determinations and denied 3.2 million, about 6.4%. Only 11.7% of denied requests were appealed. From 2019 through 2023, when people did appeal, 81.7% of denied prior authorizations that were appealed were at least partially overturned.

The Office of Inspector General at the Department of Health and Human Services reviewed denials and found that among prior authorization requests that Medicare Advantage organizations denied, 13% met Medicare coverage rules, meaning they likely would have been approved under Original Medicare.

That is the reality of a system that rewards “no” unless someone has the time and stamina to fight.

Have you wondered why the ads never stop

Plans buy enrollment because each new member converts into roughly a $1,200-per-month taxpayer payment stream, and the sales machine costs about $18 a month per member to run.

If you wonder why Medicare Advantage marketing feels nonstop, the numbers explain it.

KFF found 643,852 English-language Medicare-related television ad airings between October 1 and December 7, 2022, an average of more than 9,500 per day, and more than 85% of those airings were for Medicare Advantage plans.

That saturation is not public education. It is customer acquisition.

A Senate Finance Committee investigation found insurer spending on “agents and brokers fees and commissions” rose from $2.4 billion in 2018 to $6.9 billion in 2023, nearly tripling.

The payoff is simple: enrollment is a monthly government payment stream, and higher documented risk can increase that stream.

Marketing outran oversight

To understand why enforcement has lagged, compare scale.

Broker and agent compensation alone reached $6.9 billion in 2023 among the insurers reviewed by Senate Finance.

CMS reports it obligated $1.6 billion in fiscal year 2023 for the Medicare Integrity Program across Medicare program integrity activities. These are not identical categories and they are not Medicare Advantage-only spending, but the scale mismatch helps explain why marketing capacity can outrun oversight capacity.

What MedPAC says about risk-score inflation

The Medicare Payment Advisory Commission (MedPAC) has repeatedly warned that Medicare Advantage plans report higher patient risk scores than Original Medicare does for similar patients, partly through higher coding intensity.

MedPAC found that in 2021, Medicare Advantage risk scores were 12.1% higher than Original Medicare scores for comparable patients.

Even after mandatory coding adjustments, Medicare Advantage risk scores remain significantly inflated compared to what those same patients would generate in Original Medicare. This translates directly into billions in extra payments to private insurers.

This matters because if payment rises with risk scores, documenting more diagnoses becomes a revenue strategy even when it does not change treatment.

Decoder box: the four terms you will see in this story

RADV (Risk Adjustment Data Validation): CMS’s audit program for Medicare Advantage. It checks whether diagnoses that boosted payments are supported by records.

HCC (Hierarchical Condition Category): a standardized “condition bucket” used to calculate risk scores. More and higher HCCs generally raise plan payment.

HPMS (Health Plan Management System): CMS’s secure portal where plans submit required data and receive official guidance.

I-SNP: an institutional Medicare Advantage plan, often used for nursing home residents.

What public estimates suggest

Until 2025, CMS audited about 60 contracts per year out of 550 plus total. With a typical lookback and multi-year resolution timeline, a plan could code aggressively for years before facing financial consequences.

Public estimates place Medicare Advantage overpayments in the tens of billions annually. CMS cites federal estimates around $17 billion per year, and notes MedPAC estimates could be as high as $43 billion per year. (These are public estimates used to describe scale, not a prediction of what any specific audit will recover.)

Illustrative scale only: across payment years 2018 through 2024, that range is roughly $119 billion to $301 billion in potential excess payments. This is not a CMS total of the audit backlog. It is a way to understand the magnitude of the years now under review.

Why the nursing home investigation matters

The Senate Finance Committee is not investigating coding theory. It is investigating deaths.

According to the Senate letter, whistleblowers allege the company pressured nursing homes not to send residents to hospitals, and that patients died as a result. The reporting trail includes documented cases and additional allegations.

Here is why the audit story and the nursing home story connect. Medicare Advantage plans maximize profit through a two-step process:

Diagnose patients with more conditions than necessary to justify higher monthly payments from Medicare.

Deny expensive care to minimize spending

A nursing home patient that codes with multiple chronic conditions can generate high risk-adjusted payments. Institutional care and hospital admissions can be high-cost.

Illustrative incentive math:

If a hospital transfer is denied or delayed, a plan can avoid a large acute-care expense while continuing to collect monthly payments. Actual costs and outcomes vary by payer mix, contract structure, clinical condition, and what care is covered under Medicare, Medicaid, or private pay.

The official language is “utilization management ensures appropriate care.” The allegation is that systems were used to deny transfers while clinicians spent critical time fighting for authorization as conditions deteriorated.

The 15-minute move (do this today)

If Medicare Advantage touches your household, do these three things now, before you need them in a crisis:

Confirm the parent company. Your card may show a local plan name. The parent company matters.

Start a denial and delay folder. Save every prior authorization denial, “does not meet criteria” note, equipment denial, network-change letter, and appeal response from the last 12 months. Save copies outside the plan portal.

If a loved one is in a nursing facility: ask the facility, in writing, what the plan’s process is for hospital transfer authorization and what number they call for urgent escalation.

Member toolkit note

If this touches your household, the rest of this post becomes an action plan.

Paid members get the Extraction Defense Kit tools that match the three most common failure points:

Healthcare Module: the step-by-step prior authorization protocol, the denial documentation checklist, and escalation scripts that force timelines and criteria in writing.

Red Flag Glossary: plain-English translations of stall phrases like “does not meet criteria” with the exact follow-up questions that break the loop.

PBM Toolkit: if the fight is about prescriptions inside Medicare Advantage, including formulary exceptions and appeal language.

Continue below for the document path, deadlines, and the evidence packet workflow. Upgrade to read the full post and unlock the Kit.

Subscriber discount ends January 23. (Lock in a whole year of savings with the annual plan)